While Alisher Usmanov is receiving distinguished (and not so distinguished) guests from Moscow in Tashkent on the occasion of his 70th birthday, the miners of the Lebedinsky GOK congratulated him in oriental style. As reported by the source of the telegram channel VChK-OGPU and Rucriminal.info, minority shareholders of the Lebedinsky GOK, who lost their shares during a forced buyout at a cheap price, which was made by the structures of Alisher Usmanov, sent sincere wishes of peace to the hero of the day Usmanov and reminded him that his company bought shares of LGOK through a unilateral transaction at a reduced price. According to the miners, Metalloinvest underestimated the value of the seized shares by 3-4 times the market price, as required by the Law, and used a fraudulent scheme with double valuation.

We have already written about the conflict between the minority shareholders of the Lebedinsky GOK dispossessed by Metalloinvest, which now may result in a new scandal involving a Western bank.

Moreover, minority shareholders of LGOK (the largest iron ore producer) filed a statement of claim with the Federal Constitutional Court of Germany against the oligarch’s company, defining its actions as fraudulent in carrying out a forced buyout of minority shares of shareholders, with the participation of Deutsche Bank.

Obviously, a new international scandal is coming for Deutsche Bank and other Western credit institutions that were indirectly involved in the legalization of income of Russian companies that achieved financial success through the “legalized” seizure of property of Russian citizens through forced redemption. Or simply robbery for three rubles, as for example, the Rottenbergs did with alcohol producers.

If successful in the German courts, for the disadvantaged miners of Metalloinvest, as well as for all citizens of Russia, the hitherto unshakable electorate of the unchangeable president, who somehow fell under the steamroller of the money-grubbing friends of Putin, a precedent may be created for achieving justice in the courts of Europe.

Statement

Andrey Burkin, the official representative of the group of former minority shareholders of the Lebedinsky mining and processing plant, which is the main production asset of the Metalloinvest holding with beneficiaries:

Alisher Usmanov – 45%;

VTB Bank – 20% (in fact – V. Putin);

Ardavan Farhad Moshiri – 5% (close friend of Alisher Usmanov and custodian of sanctioned assets).

In 2007, our shares in Lebedinsky GOK JSC were taken away through a forced buyout by Gazmetall/Metalloinvest as the majority shareholder. According to the new amendments to the law on joint stock companies, the majority shareholder, in order to force the redemption of our shares, assessed the value of our enterprise on the basis of deliberately underestimated data on its profitability.

We could not agree with the undervaluation of our company and proposed to Alisher Usmanov (document 1), as the main beneficiary and majority shareholder, to reconsider the value of our seized shares taking into account the actual profitability that was hidden in the offshore companies controlled by him. There was an immediate response with a firm promise to review the value of our selected shares based on a fair and objective valuation.

Instead of fulfilling this promise, as it turned out, the company’s lawyers were playing for time in order to miss the statute of limitations in our case (6 months). These tricks forced us to file a lawsuit and conduct our own investigation into the circumstances of the buyout and obtain an objective independent assessment of the Lebedinsky GOK. Two independent assessments confirmed we were right! However, by that time the entire judicial system of the Russian Federation was absolutely corrupt at all levels.

The unique documents that we were able to collect indicate transfer pricing and the concentration of 75% of our company’s export revenue on the offshores of the main beneficiaries. None of these documents, including actual export contracts, were even accepted for consideration by any court of the Russian Federation, since this obligated the judge to initiate a criminal case under the article “Tax evasion on a particularly large scale.” Moreover, the documents at our disposal (Recommended Cash Offer by FMC for Europe Steel PLC) indicate tax evasion in the EU and UK by companies of the main shareholders registered in your jurisdiction.

Realizing the futility of our attempts to achieve justice in the jurisdiction of the Russian Federation, we turned to the London Law Firm (ILaw) for help, which, together with the Barrister of the Royal Council, Paul O'Docherty, pointed out to us clear signs that fall under the definition of fraud. Namely: in one short (about 6 months) period, the Metalloinvest Management Company ordered and received two official assessments of our enterprises with different initial data, completely different results, for different target audiences and for different purposes.

The first assessment of Lebedinsky GOK and OEMK was carried out by a company with an extremely low reputation (Gorislavtsev and Co. Valuation) for the purpose of forced redemption, and the second valuation of our enterprises was carried out by the London branch of Deutsche Bank AG for the purpose of an IPO on the London Stock Exchange.

On January 30, 2022, we received an official document, the Metalloinvest Finance Eurobond Prospectus, with real financial data of our Plant. This document was created to attract investment with the participation of the world's leading credit institutions led by Deutsche Bank (document attached).

The role of Deutsche Bank in our case deserves special attention! A year ago, we asked Deutsche Bank to disclose to us, as shareholders*, information about the assessment of our company, providing the Bank's management with evidence of the forced write-off of our shares from our DEPO accounts by order of Metalloinvest. To our first request, we received a response from the Bank about its non-involvement in the criminal offense. A second official statement received by the Bank on July 16, 2023 addressed to Dr. Jörg Muecke, Head of the Legal Department and Mrs. Christina Hentke, Lawyer of Deutsche Bank, remained unanswered.

We believe that the actions of Deutsche Bank officials may fall within the definition of Section 263(1) of the German Criminal Code: a person who, with the intent of obtaining an unlawful financial benefit for himself or a third party, damages the property of another person by causing or perpetuating a mistake by misrepresenting facts or distorting or concealing the true facts is subject to prosecution.

Betrug ist in § 362 StGB geregelt. Gemäß § 263 Abs. 1 StGB ist strafbar, wer in der Absicht, sich oder einem Dritten einen rechtswidrigen Vermögensvorteil zu verschaffen, das Vermögen eines anderen dadurch beschädigt, daß er durch Vorspiegelung falscher oder durch Entstellung oder Unterdrückung wahrer T atsachen einen Irrtum erregt oder unterhält.

In view of the above, and our firm commitment to seek justice and protection of our private property rights in German jurisdiction, we request:

- oblige Deutsche Bank to provide us with documents on the assessment of Lebedinsky GOK, compiled in 2008 by order of Metalloinvest. Documents are stored in the Deutsche Bank archive for 15 years.

By helping us restore our right to private property, you can set a precedent for protecting the rights of disadvantaged Russian citizens in the jurisdiction of Western democracies, with significant implications for the security of Europe. By doing this you will not only restore justice, but also stop fraudulent financial flows going to finance the bloody, monstrous war in Ukraine.

Yours sincerely,

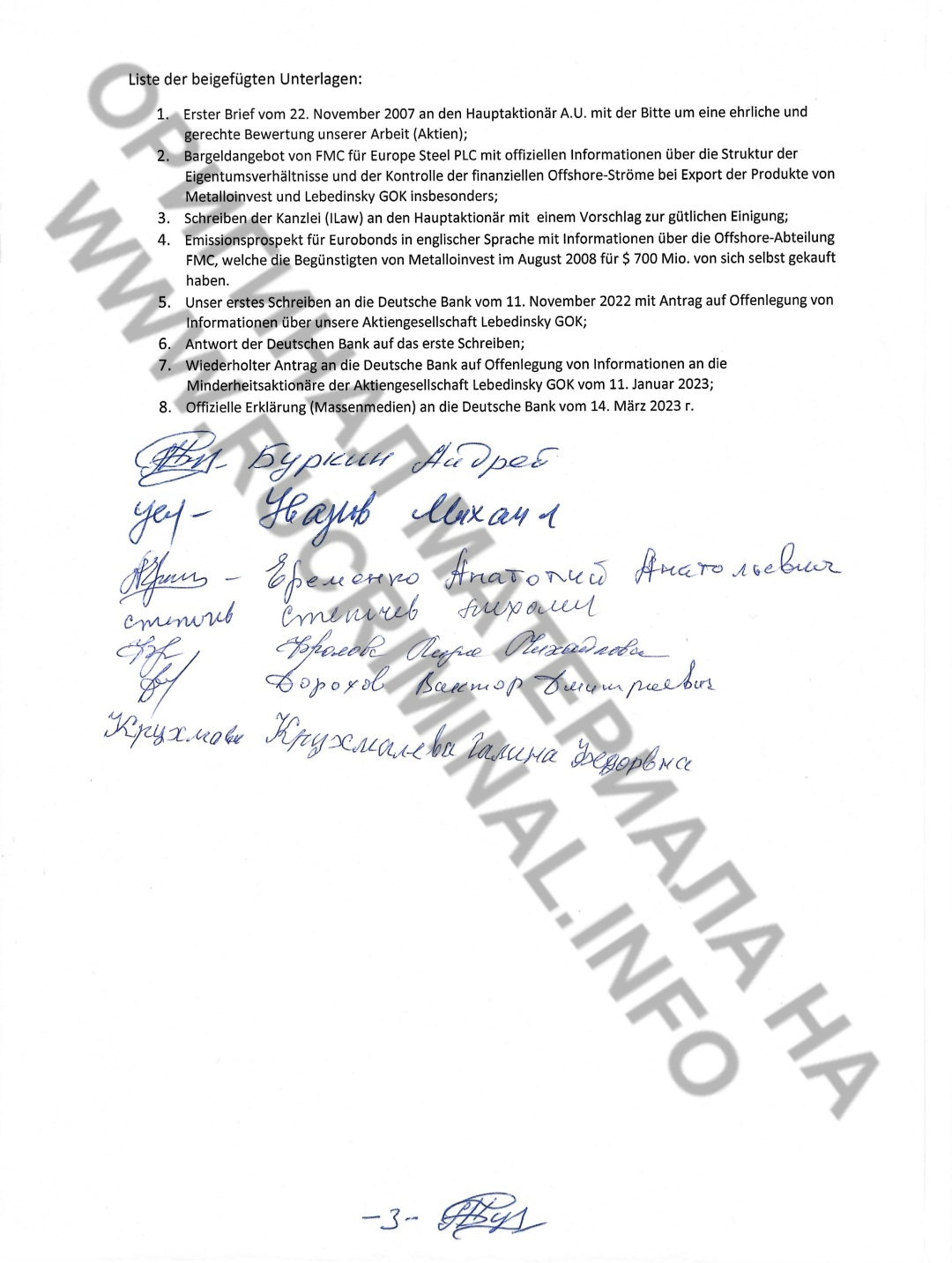

Andrey Burkin and a group of shareholders

Timofey Grishin

To be continued

Source: www.rucriminal.info

Комментариев нет:

Отправить комментарий