As it became known to Rucriminal.info, the investigation into the theft of land in Sochi has reached a new level.

This investigation began in the summer of 2021, when the judge of the Supreme Court of the Russian Federation Alexander Klikushin left his post. In certain circles, the case caused bewilderment: Klikushin's career was at its zenith, and the post of judge of the Supreme Court is not so easy to leave. That is why representatives of our publication began to find out the details.

As it turned out, the real reason for the resignation of Alexander Klikushin was that he was at the center of a scandal involving the misappropriation of an impressive piece of land in Sochi. To understand how things were, you need to understand the details in detail.

What happened

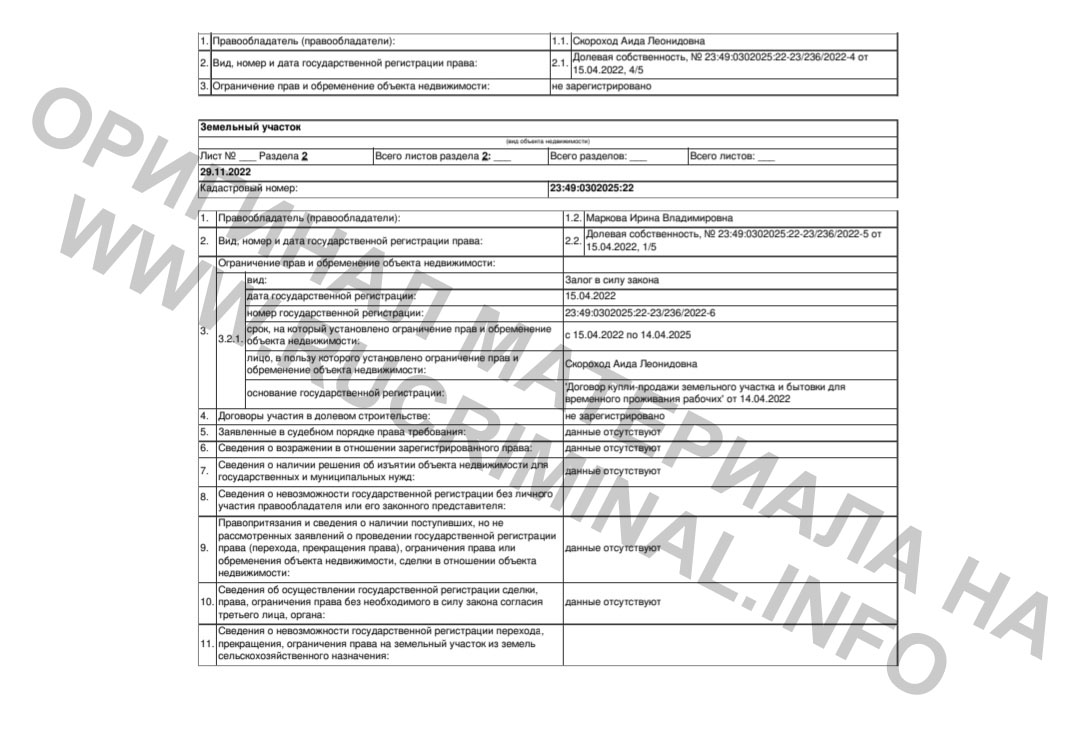

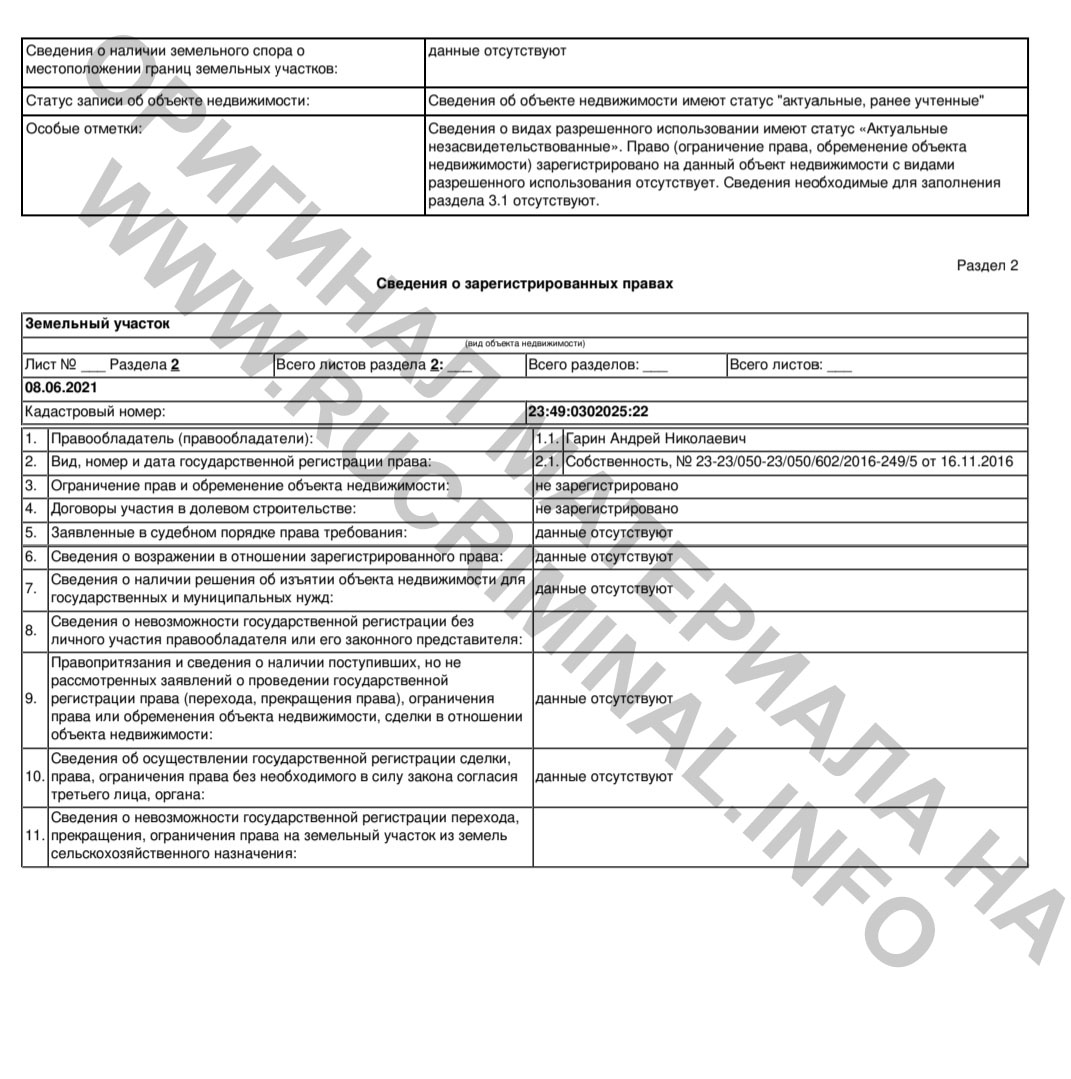

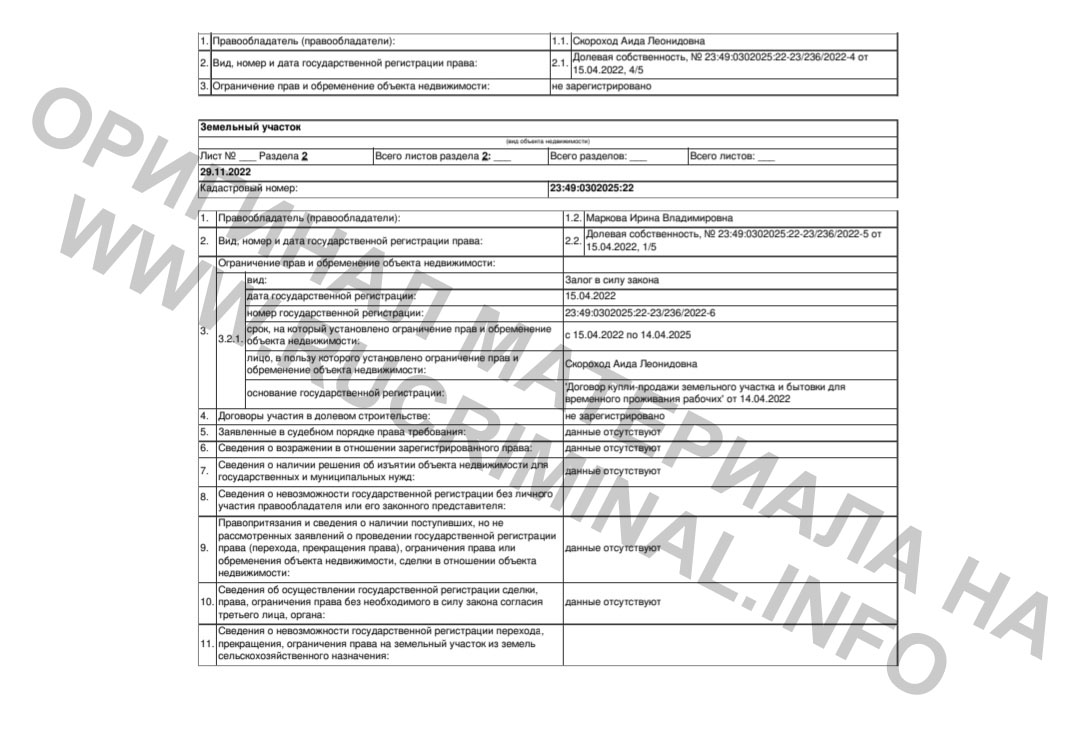

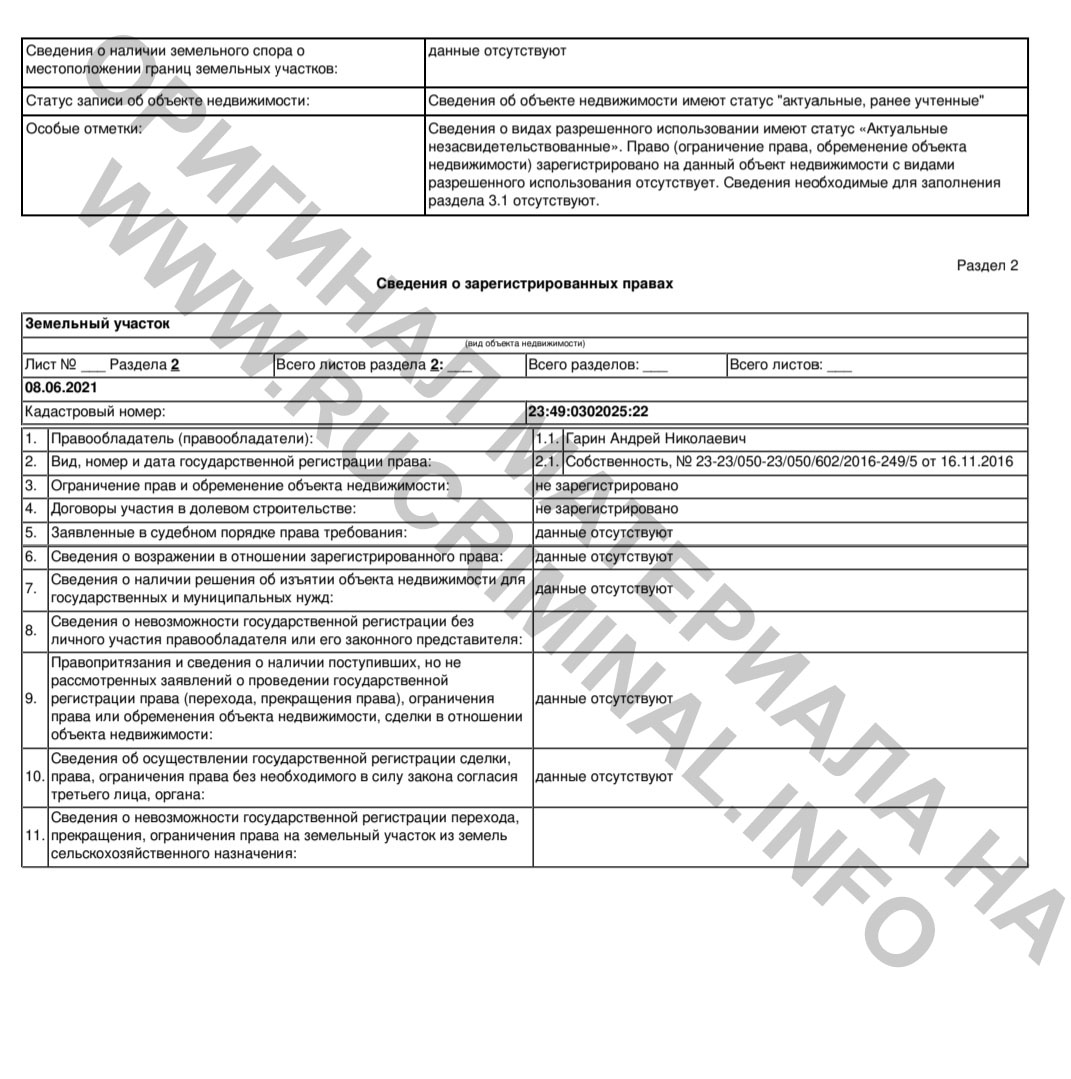

In addition to the judge, the defendants in the case are the Garin couple: Andrey Nikolaevich and Lyudmila Anatolyevna, as well as Lyudmila Anatolyevna's mother, Skorokhod Aida Leonidovna, and family friend Vladimir Aleksandrovich Nazaryan. For several years, all of the above persons have been building a scheme related to the illegal acquisition of land in Sochi, the total cost of which exceeded several hundred million rubles.

As it became known to Rucriminal.info, the above persons received free ownership of state and municipal lands in Sochi. And Klikushin contributed to the impossibility of appealing against unjust court decisions, which was helped by his high position. As a result, he also received the lion's share of the land.

The case was based on the fact that in June 2016 Aida Leonidovna Skorokhod claimed the rights to the lands, which at that time belonged to the Montazhnik gardening partnership. In her lawsuit, she indicated that in 1994, land plots located next to her house, with an area of 2350 square meters, were transferred to her ownership. m., 1870 sq. m., and 1475 sq. m. for personal subsidiary plots. And by the decision of the Khostinsky District Court of Sochi dated June 29, 2016 in case No. 2-1833 / 2016, the court recognized her ownership of these three land plots.

But this is only an exposition, and it was analyzed in detail in two previous articles. And now we want to discuss in detail another side of the issue - tax. We will talk about Nazaryan Vladimir Alexandrovich, who, we recall, is a friend of the Garin family, and Garin's mother-in-law Skorokhod Aida Leonidovna.

A new turn in business

It should be noted right away that the Garin family never lived in poverty. Moreover, she had a fairly impressive income. In particular, from 2010 to 2016. they kept a hotel with rooms for vacationers. But at the same time, they did not declare their income. As well as do not pay taxes on the sale of land and real estate.

How could this happen? A completely logical answer is due to connections in the highest circles of the city of Sochi, which not only turned a blind eye to fraud, but also actively contributed to the Garin family. So, for example, the court proceedings described above on the transfer of property rights to land plots to Ms. Skorokhod were practically without any proceedings. There were no examinations, no requests for documents from the archive. She was simply "returned" the rights to the land. Amazing, isn't it?

It is worth studying the ins and outs of a family friend - Vladimir Alexandrovich Nazaryan. In 2015, he appropriated 11 land plots with cadastral numbers 23:49:0306002:1393, 23:49:0306002:1400, 23:49:0306002:1391, 23:49:0306002:1403, 23:49:0306002:1387 total area almost 11,000 sq.m. Comrade Nazaryan decided not to deny himself anything, he definitely does not differ in modest appetites.

Nazaryan claimed that he bought all of the above plots from their rightful owner Kosenkov V.P. back in 2001. There is just one caveat here.

At the time of the alleged conclusion of the deal, Mr. Kosenkov was in prison, therefore, he could not in any way carry out any manipulations with real estate, including selling it. Moreover, Kosenkov found out that another person now owns his property only after his release. He planned to file a lawsuit, but this never happened. As can be assumed, the case could not have been without the intervention of a third party, which by all means prevented the filing of a claim.

As a result, Nazaryan remained the owners of all eleven sites. Moreover, he soon sold nine of them, having received an extremely impressive sum of money in his hands.

After this case nevertheless received publicity, the tax inspectorate No. 7 for the Krasnodar Territory began to investigate. In particular, they repeatedly sent letters to both Skorokhod and Nazaryan with a demand to submit personal income tax declarations. However, they ignored these demands and did not enter into any contacts with the tax authorities, so as not to be under investigation.

The tax inspectorate filed lawsuits against Skorokhod and Nazaryan. In the case of Skorokhod, the first instance (Lazarevsky District Court) satisfied filed a tax lawsuit (case No. 2-277 / 2022. Skorokhod filed an appeal with the Lazarevsky District Court (case No. 33-22568 / 2022), but even after it the decision of the first instance was upheld.

As a result of the MRI of the Federal Tax Service No. 7 for the Krasnodar Territory, she filed a lawsuit against Skorokhod A.L. to oblige her to submit a declaration on income tax of an individual for 2016-2020.

In support of the stated requirements indicated that Skorokhod A.L. made transactions for the alienation of property for a large amount. If you understand in detail, then the cost of each object was as follows:

• a land plot with an area of 804 sq.m, with an actual cadastral value of 2,973,626.16 rubles;

• a land plot with an area of 1475 sq.m, with an actual cadastral value of 2,062,640 rubles;

• a land plot with an area of 1870 sq.m., with an actual cadastral value of 2,615,008 rubles;

• a land plot with an area of 600 sq.m., with an actual cadastral value of 10,122 rubles;

• a land plot with an area of 875 sq.m., with an actual cadastral value of 1,327,261.25 rubles;

• an apartment with an area of 22.90 sq.m., with an actual cadastral value of 802,341.80 rubles;

• an apartment with an area of 25.60 sq.m., with an actual cadastral value of 1,622,742.78 rubles.

The plaintiff repeatedly sent notifications to the taxpayer about the need to submit a tax return and appear to give explanations, which were left unsatisfied by the defendant.

According to the claim of Nazaryan, things were somewhat more complicated. The first instance (Lazarevskiy District Court of Sochi) satisfied the tax claim (case No. 2-524/2022), but Nazaryan similarly filed an appeal with the Krasnodar Regional Court (case No. 33-15952/2022), which was satisfied in his favor. However, later the Fourth Court of Cassation overturned the appeal decision (case No. 8G-26945/2022) and remanded the case for a new trial. This happened in November 2022, so more details on the case should be expected for the foreseeable future.

After the release of the material about the Garins, the judges who made unfair decisions with the assistance of Klikushin began to act more adequately, fearing publicity and loss of reputation. The only place where Sochi Alyam Capone is still being met is the Krasnodar Regional Court. In particular, Judge Parkhomenko Galina Vitoslavovna cancels the decision of the Lazarevsky District Court in case No. 2-524/2022 under the patronage of Garin (Case No. 33-15952/2022) and she leaves unchanged the fair decision of the Lazarevsky District Court (Case No. ) according to Skorokhod (Case No. 33-22568/2022). How long this state of affairs will last, and how long the judges of the Krasnodar Regional Court will meet them halfway, time will tell.

How much the defendants owe to the state

If we make the most conservative calculations, it turns out that Skorokhod must pay the state about 1.5 million rubles, that is, 13% of the 11.6 million rubles that she received for the sale of real estate in accordance with the current tax rate. The Nazarene owes the state no less. And this is despite the current difficult situation in the state, when the SVO is being launched, and conscious citizens donate their own money to help the army and the affected civilian population of the LPR and DPR! We can only hope that the court decision will be fair, then both Skorokhod and Nazaryan will be obliged to pay what they withheld.

The public is actively following the case

The Krasnodar Tax Inspectorate actively took up the problem, hoping to solve it as soon as possible, but the Moscow Tax Inspectorate No. 36, where Garin's affairs are being handled, is practically inactive. Time will tell how this will affect the outcome of the proceedings.

It is worth noting that thanks to the publications of the Cheka UCP and Rucriminal.info, the relevant authorities began to act.

In particular, a complaint was sent to the Moscow Tax Inspectorate detailing the state of affairs. It contains information that before the entry into force of the decision of the Khostinsky District Court of Sochi in 2016, Garin A.N. bought a land plot from the Administration of Sochi, which is located in a sanatorium-resort zone. After that, he gave or sold it to his mother-in-law Skorokhod A.L. This is confirmed by documents, including an extract from the USRN. Accordingly, Garin had to pay personal income tax in favor of the state, since at the time of the sale of the said land plot he owned the property for less than 5 years

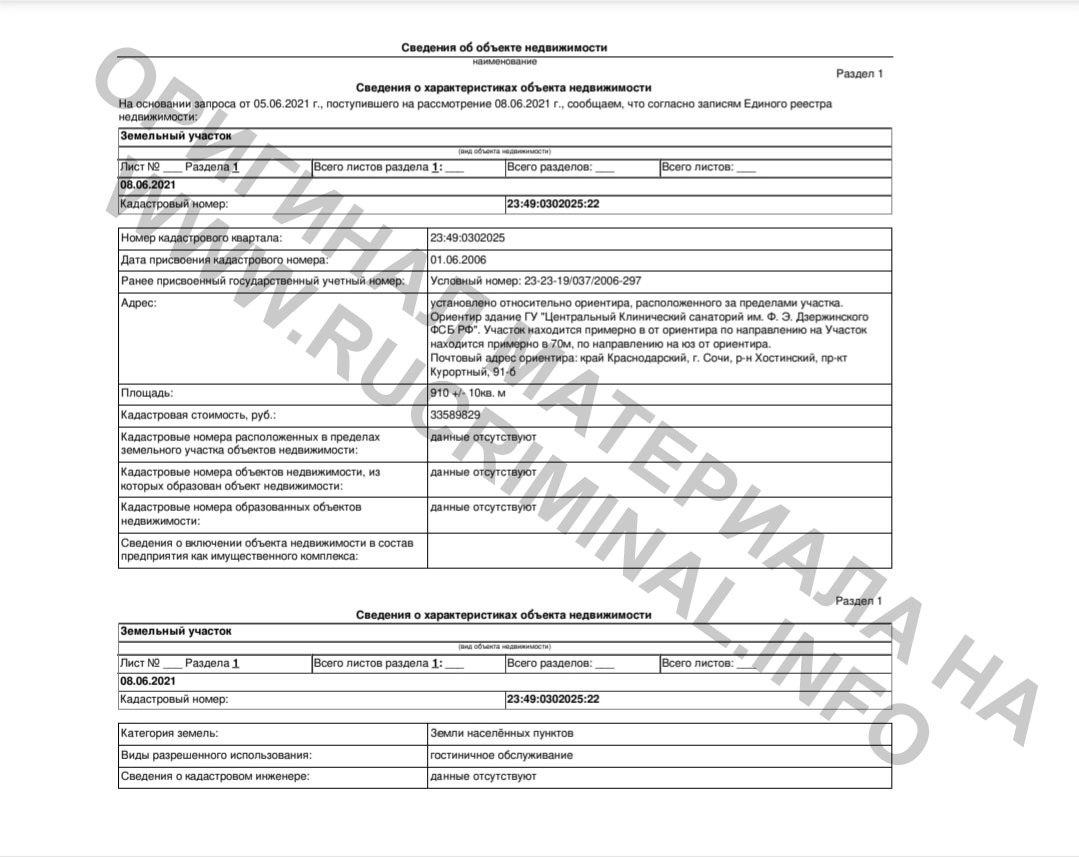

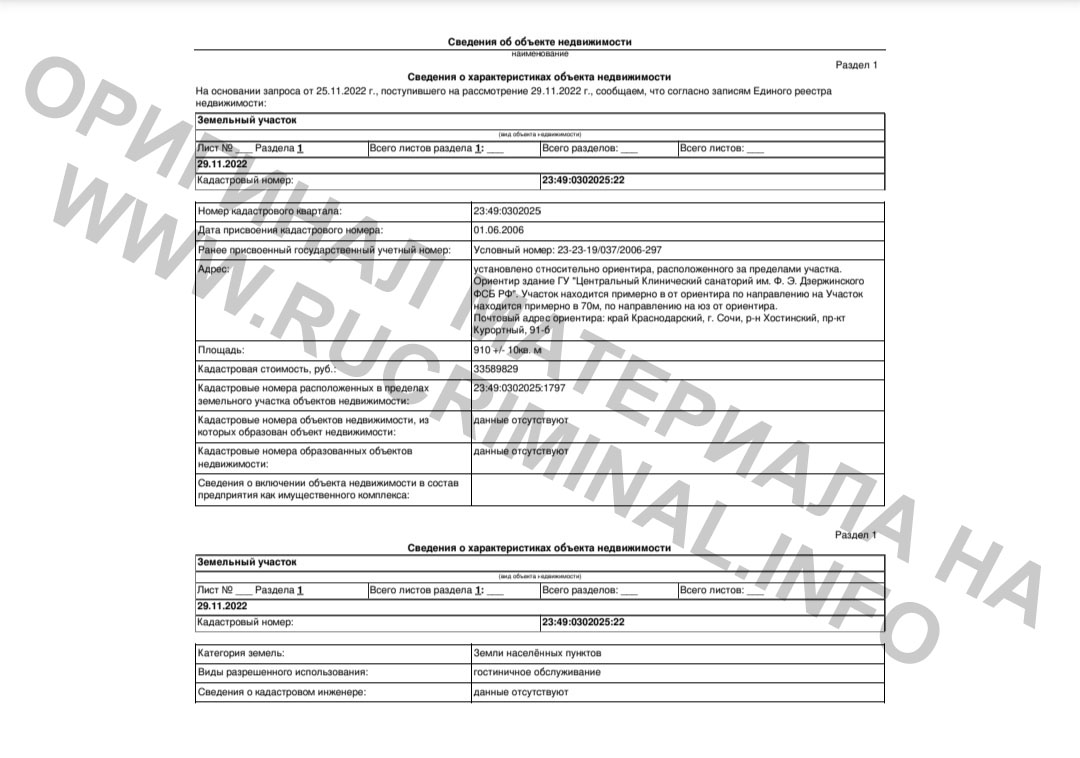

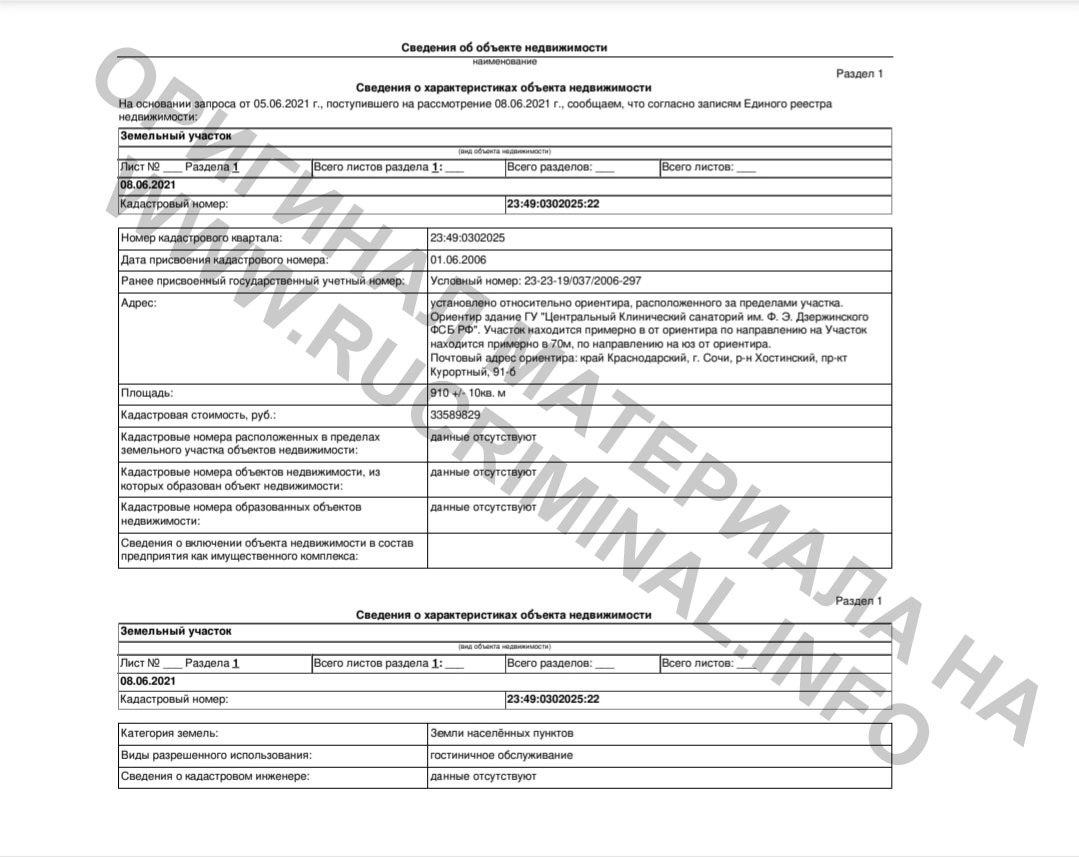

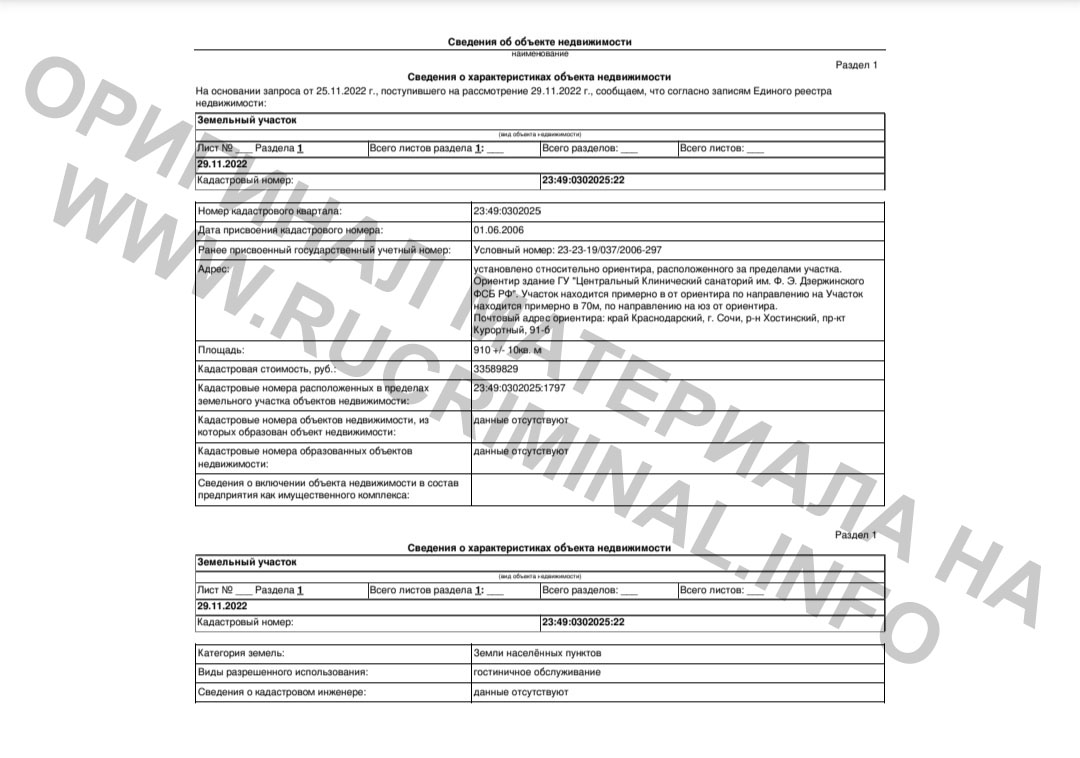

According to information from the USRN, the cadastral value of a land plot with cadastral number 23:49:0302025:22 is 33,589,829 rubles. Consequently, the minimum amount of personal income tax that Garin A.N. must pay in favor of the state in the event of the sale of the said land plot Skorokhod A.L. is 3,651,932.04 rubles. If there was an act of donation, then Skorokhod should have paid the tax, since she is not a close relative of Garin.

However, at the moment, neither Skorokhod nor Garin have paid the due amount, therefore, they have not paid the state.

The petition contains a request to send instructions to the Federal Tax Service, the Investigative Committee of the Russian Federation on conducting an audit on this complaint with a view to committing tax offenses by Garin Andrey Nikolaevich, Skorokhod Aida Leonidovna. However, there has been no response to it so far.

In conclusion, it can be assumed that the Garin family and their accomplices, even after the resignation of Judge Klikushin, who actively assisted them, still had significant connections in Moscow. They help solve a number of problems. In our difficult time, during a special operation, when the budget needs tax replenishment, some dishonest people cover for malicious tax evaders. This must be resolutely stopped.

Roman Trushkin

To be continued

Source: www.rucriminal.info

This investigation began in the summer of 2021, when the judge of the Supreme Court of the Russian Federation Alexander Klikushin left his post. In certain circles, the case caused bewilderment: Klikushin's career was at its zenith, and the post of judge of the Supreme Court is not so easy to leave. That is why representatives of our publication began to find out the details.

As it turned out, the real reason for the resignation of Alexander Klikushin was that he was at the center of a scandal involving the misappropriation of an impressive piece of land in Sochi. To understand how things were, you need to understand the details in detail.

What happened

In addition to the judge, the defendants in the case are the Garin couple: Andrey Nikolaevich and Lyudmila Anatolyevna, as well as Lyudmila Anatolyevna's mother, Skorokhod Aida Leonidovna, and family friend Vladimir Aleksandrovich Nazaryan. For several years, all of the above persons have been building a scheme related to the illegal acquisition of land in Sochi, the total cost of which exceeded several hundred million rubles.

As it became known to Rucriminal.info, the above persons received free ownership of state and municipal lands in Sochi. And Klikushin contributed to the impossibility of appealing against unjust court decisions, which was helped by his high position. As a result, he also received the lion's share of the land.

The case was based on the fact that in June 2016 Aida Leonidovna Skorokhod claimed the rights to the lands, which at that time belonged to the Montazhnik gardening partnership. In her lawsuit, she indicated that in 1994, land plots located next to her house, with an area of 2350 square meters, were transferred to her ownership. m., 1870 sq. m., and 1475 sq. m. for personal subsidiary plots. And by the decision of the Khostinsky District Court of Sochi dated June 29, 2016 in case No. 2-1833 / 2016, the court recognized her ownership of these three land plots.

But this is only an exposition, and it was analyzed in detail in two previous articles. And now we want to discuss in detail another side of the issue - tax. We will talk about Nazaryan Vladimir Alexandrovich, who, we recall, is a friend of the Garin family, and Garin's mother-in-law Skorokhod Aida Leonidovna.

A new turn in business

It should be noted right away that the Garin family never lived in poverty. Moreover, she had a fairly impressive income. In particular, from 2010 to 2016. they kept a hotel with rooms for vacationers. But at the same time, they did not declare their income. As well as do not pay taxes on the sale of land and real estate.

How could this happen? A completely logical answer is due to connections in the highest circles of the city of Sochi, which not only turned a blind eye to fraud, but also actively contributed to the Garin family. So, for example, the court proceedings described above on the transfer of property rights to land plots to Ms. Skorokhod were practically without any proceedings. There were no examinations, no requests for documents from the archive. She was simply "returned" the rights to the land. Amazing, isn't it?

It is worth studying the ins and outs of a family friend - Vladimir Alexandrovich Nazaryan. In 2015, he appropriated 11 land plots with cadastral numbers 23:49:0306002:1393, 23:49:0306002:1400, 23:49:0306002:1391, 23:49:0306002:1403, 23:49:0306002:1387 total area almost 11,000 sq.m. Comrade Nazaryan decided not to deny himself anything, he definitely does not differ in modest appetites.

Nazaryan claimed that he bought all of the above plots from their rightful owner Kosenkov V.P. back in 2001. There is just one caveat here.

At the time of the alleged conclusion of the deal, Mr. Kosenkov was in prison, therefore, he could not in any way carry out any manipulations with real estate, including selling it. Moreover, Kosenkov found out that another person now owns his property only after his release. He planned to file a lawsuit, but this never happened. As can be assumed, the case could not have been without the intervention of a third party, which by all means prevented the filing of a claim.

As a result, Nazaryan remained the owners of all eleven sites. Moreover, he soon sold nine of them, having received an extremely impressive sum of money in his hands.

After this case nevertheless received publicity, the tax inspectorate No. 7 for the Krasnodar Territory began to investigate. In particular, they repeatedly sent letters to both Skorokhod and Nazaryan with a demand to submit personal income tax declarations. However, they ignored these demands and did not enter into any contacts with the tax authorities, so as not to be under investigation.

The tax inspectorate filed lawsuits against Skorokhod and Nazaryan. In the case of Skorokhod, the first instance (Lazarevsky District Court) satisfied filed a tax lawsuit (case No. 2-277 / 2022. Skorokhod filed an appeal with the Lazarevsky District Court (case No. 33-22568 / 2022), but even after it the decision of the first instance was upheld.

As a result of the MRI of the Federal Tax Service No. 7 for the Krasnodar Territory, she filed a lawsuit against Skorokhod A.L. to oblige her to submit a declaration on income tax of an individual for 2016-2020.

In support of the stated requirements indicated that Skorokhod A.L. made transactions for the alienation of property for a large amount. If you understand in detail, then the cost of each object was as follows:

• a land plot with an area of 804 sq.m, with an actual cadastral value of 2,973,626.16 rubles;

• a land plot with an area of 1475 sq.m, with an actual cadastral value of 2,062,640 rubles;

• a land plot with an area of 1870 sq.m., with an actual cadastral value of 2,615,008 rubles;

• a land plot with an area of 600 sq.m., with an actual cadastral value of 10,122 rubles;

• a land plot with an area of 875 sq.m., with an actual cadastral value of 1,327,261.25 rubles;

• an apartment with an area of 22.90 sq.m., with an actual cadastral value of 802,341.80 rubles;

• an apartment with an area of 25.60 sq.m., with an actual cadastral value of 1,622,742.78 rubles.

The plaintiff repeatedly sent notifications to the taxpayer about the need to submit a tax return and appear to give explanations, which were left unsatisfied by the defendant.

According to the claim of Nazaryan, things were somewhat more complicated. The first instance (Lazarevskiy District Court of Sochi) satisfied the tax claim (case No. 2-524/2022), but Nazaryan similarly filed an appeal with the Krasnodar Regional Court (case No. 33-15952/2022), which was satisfied in his favor. However, later the Fourth Court of Cassation overturned the appeal decision (case No. 8G-26945/2022) and remanded the case for a new trial. This happened in November 2022, so more details on the case should be expected for the foreseeable future.

After the release of the material about the Garins, the judges who made unfair decisions with the assistance of Klikushin began to act more adequately, fearing publicity and loss of reputation. The only place where Sochi Alyam Capone is still being met is the Krasnodar Regional Court. In particular, Judge Parkhomenko Galina Vitoslavovna cancels the decision of the Lazarevsky District Court in case No. 2-524/2022 under the patronage of Garin (Case No. 33-15952/2022) and she leaves unchanged the fair decision of the Lazarevsky District Court (Case No. ) according to Skorokhod (Case No. 33-22568/2022). How long this state of affairs will last, and how long the judges of the Krasnodar Regional Court will meet them halfway, time will tell.

How much the defendants owe to the state

If we make the most conservative calculations, it turns out that Skorokhod must pay the state about 1.5 million rubles, that is, 13% of the 11.6 million rubles that she received for the sale of real estate in accordance with the current tax rate. The Nazarene owes the state no less. And this is despite the current difficult situation in the state, when the SVO is being launched, and conscious citizens donate their own money to help the army and the affected civilian population of the LPR and DPR! We can only hope that the court decision will be fair, then both Skorokhod and Nazaryan will be obliged to pay what they withheld.

The public is actively following the case

The Krasnodar Tax Inspectorate actively took up the problem, hoping to solve it as soon as possible, but the Moscow Tax Inspectorate No. 36, where Garin's affairs are being handled, is practically inactive. Time will tell how this will affect the outcome of the proceedings.

It is worth noting that thanks to the publications of the Cheka UCP and Rucriminal.info, the relevant authorities began to act.

In particular, a complaint was sent to the Moscow Tax Inspectorate detailing the state of affairs. It contains information that before the entry into force of the decision of the Khostinsky District Court of Sochi in 2016, Garin A.N. bought a land plot from the Administration of Sochi, which is located in a sanatorium-resort zone. After that, he gave or sold it to his mother-in-law Skorokhod A.L. This is confirmed by documents, including an extract from the USRN. Accordingly, Garin had to pay personal income tax in favor of the state, since at the time of the sale of the said land plot he owned the property for less than 5 years

According to information from the USRN, the cadastral value of a land plot with cadastral number 23:49:0302025:22 is 33,589,829 rubles. Consequently, the minimum amount of personal income tax that Garin A.N. must pay in favor of the state in the event of the sale of the said land plot Skorokhod A.L. is 3,651,932.04 rubles. If there was an act of donation, then Skorokhod should have paid the tax, since she is not a close relative of Garin.

However, at the moment, neither Skorokhod nor Garin have paid the due amount, therefore, they have not paid the state.

The petition contains a request to send instructions to the Federal Tax Service, the Investigative Committee of the Russian Federation on conducting an audit on this complaint with a view to committing tax offenses by Garin Andrey Nikolaevich, Skorokhod Aida Leonidovna. However, there has been no response to it so far.

In conclusion, it can be assumed that the Garin family and their accomplices, even after the resignation of Judge Klikushin, who actively assisted them, still had significant connections in Moscow. They help solve a number of problems. In our difficult time, during a special operation, when the budget needs tax replenishment, some dishonest people cover for malicious tax evaders. This must be resolutely stopped.

Roman Trushkin

To be continued

Source: www.rucriminal.info