Rucriminal.info and the telegram channel VChK-OGPU have already talked about the struggle of the shareholders of Lebedinsky GOK OJSC, who since 2007 have been seeking justice from Metalloinvest and its beneficiaries - Andrei Skoch, Alisher Usmanov and Farhad Moshiri, who, during the forced buyout of minority shares of the workforce, was a Member of the Board of Directors of Lebedinsky GOK OJSC, controlled the offshore wallet of Metalloinvest (Ferrous Metal Company) on which 75% of the net profit of LGOK was concentrated, owns 5% of the company, and also the CEO of Europe Steel plc. and Global Natural Energy plc. The miners indicate that they lost their shares in the mining and processing plant during a forced buyout, which was made by Usmanov’s structures at prices far from market prices. The assessment was carried out by the company Gorislavtsev and Co. Estimation,” which was based on the fact that the mining and processing plant’s official revenue was less than $1 billion. However, according to the applicants, in reality the revenue was underestimated by at least three times. For tax optimization purposes, products were sold at reduced prices to Usmanov’s offshore companies (BGMT and FMC ltd.), and they then sold them at market prices. As a result, the mining and processing plant's real revenue was at least $3 billion.

Andrey Burkin is the authorized representative of the miners of the Lebedinsky GOK, who lost their shares during a forced buyout at a cheap price, which was made by the structures of Alisher Usmanov.

Today we begin a detailed story about the case of the miners and the fate of Andrei Burkin, whose family took the blow from the “defender of family values” Andrei Skoch.

The editors found an interesting document detailing the nature and unique details of the unilateral transaction “Forced Redemption of Minority Shares of Lebedinsky Mining and Processing Plant” by the majority shareholder of ZAO GAZMETALL.

Today we present some pages of this document to our readers and try to understand the reason for the sharp change in mood of Andrei Skoch, a famous philanthropist with his program to support large families in the Belgorod region - why a State Duma Deputy, who stands up for family values, decided to brutally destroy the family of Andrei Burkin, the leader of a group of elderly veterans and disabled people labor of Lebedinsky GOK.

In order:

Fact No. 1. In 2006, Andrei Skoch, a deputy of the State Duma of the Russian Federation and Vasily Anisimov (a friend of President V.V. Putin) lobbied for amendments to Federal Law No. 208 “On Joint Stock Companies”, establishing the right of the majority shareholder of any joint stock company that has collected 95% to buy out the minority block of shares without the consent of the minority shareholder. Key provision of the Law: Article 84.2. clause 4 “If securities are not circulated at organized trading or are circulated at organized trading for less than six months, the price of the acquired securities cannot be lower than their market value, determined by the appraiser.”

FACT No. 2. CJSC Gazmetall/Metalloinvest, as the majority shareholder of the Joint Stock Company Lebedinsky GOK, exercised its right to compulsorily buy out minority shares of the enterprise from the Company’s workforce, amounting to about 12 thousand shareholders.

On October 10, 2007, the shares of minority shareholders of Lebedinsky GOK OJSC and OEMK OJSC were written off from the accounts of SR RECOM LLC at the request of Gazmetall CJSC, legal successor LLC Management Company Metalloinvest, in accordance with Article 7 of the Federal Law of January 5, 2006 No. 7-FZ " On amendments to the Federal Law “On Joint Stock Companies and Some Other Legislative Acts of the Russian Federation” and Article 84.8 of the Federal Law of December 26, 1996 No. 208-FZ “On Joint Stock Companies”.

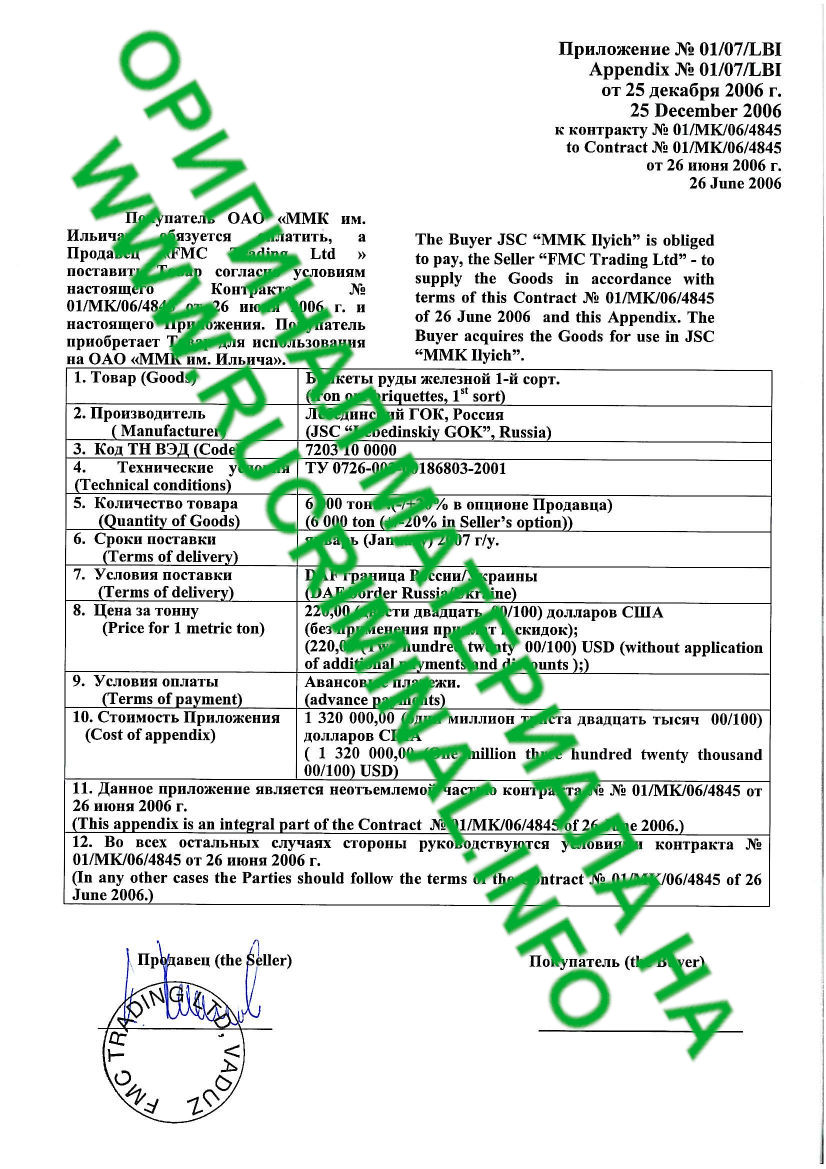

FACT No. 3. Since control over Lebedinsky GOK is the majority shareholders Skoch A.V. and Kvetnoy L.M. received back in 1999 with the help of Usmanov A.B. General Director of Gazprom Investholding, all exports of iron ore raw materials (hereinafter - iron ore) from the Lebedinsky Mining and Processing Plant (hereinafter - LGOK) went through offshore companies affiliated with the beneficiaries of Metalloinvest, BGMT Ltd. Dublin in 2002-2006, from July 2006 it was FMC Ltd. Gibraltar and FMC Trading Ltd. Liechtenstein.

When exporting national resources, a transfer pricing scheme was used.

Note: Transfer pricing, according to Andrei Skoch's lawyers, is not a violation of the Law when the marginal markup of the offshore unit controlled by Farhad Moshiri, A. Skoch and A. Usmanov does not exceed 20%.

In their press releases and commissioned “interviews,” allegedly from a former LGOK trader, Skoch and Usmanov’s PR specialists write about a 10% markup for the “external trading segment of the FMC group.” Obviously, they make these calculations based on the hope that no one will check the declared financial indicators.

The editorial office contains documents from the official reporting of the offshore company Skoch and Usmanov, produced according to EU standards.

Fact No. 4. The annual revenue of Skoch and Usmanov's companies, under the accounting records of Mr. Moshiri, amounted to 3,010 (Three billion ten million dollars) with a pre-tax profit of only about 220.9 million dollars in the year of redemption of minority shares of Lebedinsky GOK. (see Appendix 2)

Thus, taking into account the fact that of the $3 billion of FMC offshore, half comes from the export of LGOK, the revenue of the miner, and before Skoch’s arrival, the people’s enterprise should have amounted to $15 billion! In fact, LGOK gained only 26.7 billion rubles. or at the exchange rate = $1 billion.

Fact No. 5. The export volume (11 million tons/year) of production of JSC Lebedinsky GOK for the supply of iron ore to European plants was contracted annually through the offshore companies of the main shareholders of Metalloinvest at prices slightly higher than the cost of the goods. Real buyers, metallurgical plants in Europe and the rest of the world, paid the offshore of Mr. Skoch, Mr. Moshiri and Usmanov the full market value of the goods. FMC Trading Ltd was specially established for Ukrainian factories. Liechtenstein, since Ukrainian law prohibited working with offshore companies in Gibraltar.

By 2007, when the minority shares of the enterprise were written off in favor of JSC Gazmetall, the price of LGOK products had increased 5-6 times since the capture of the enterprise by the GAZMETALL group in 1999 through the gas debt of JSC LGOK to RAO GAZPROM.

The FMC offshore group has become a super profitable enterprise with annual revenues of 3-4.8 billion US dollars! (MetInv.Finance Ltd. Dublin Eurobond Prospectus. Appendix 5)

Conclusion: The revenue of the offshore division of FMC Group was many times higher than the revenue of the Lebedinsky GOK OJSC enterprise.

According to the provisions of the Tax Code of the Russian Federation, the budget arrears of the Russian Federation as a result of revenues hidden on Skoch offshores from the export of national resources (iron ore raw materials of Lebedinsky GOK JSC) amount to $1 billion. in year!

Did you remember the video response to Alexei Navalny from Alisher Usmanov with the proudly announced figure: “we paid $500 million in taxes over 10 years!”?

Fact No. 6. Minority shareholders of LGOK and OEMK have never taken part in the fair distribution of the enterprise’s profits, according to the size of their shares, as the Law somehow provides, since the profitability of the foreign trade segment of the Metalloinvest group has never been disclosed in Russia. This indicates tax evasion on a particularly large scale and infringement of the rights of minority shareholders.

Fact No. 7. The majority shareholder ordered two different assessments of enterprises included in Metalloinvest Holding Company: Lebedinsky GOK OJSC, OEMK OJSC and Mikhailovsky GOK OJSC with very different initial data, respectively, with different assessment results, since they had different goals and target audiences:

7.1. The first assessment of Lebedinsky GOK was carried out exclusively for the procedure for the forced purchase of shares of OJSC LGOK from minority shareholders in 2007.

Gorislavtsev & Co. Appraisal determined the market price of one share of Lebedinsky GOK in the amount of RUB 5,383.29 per share as corresponding to the market capitalization of the Enterprise. Or about 3.6 billion US dollars for the entire Lebedinsky GOK at the exchange rate at the time of the buyout of minority shares.;

The first assessment of the LGOK Enterprise did not take into account export revenues and super-profits of offshore companies controlled by Mr. A. Skoch, Mr. F. Moshiri and A. Usmanov, which has been concentrated since 2002 on BGMT Ltd. Dublin and since summer 2006 at FMC Group. exceeding US$3 billion in redemptions in a year.

Half of the offshore revenue of the Company’s “foreign trade division” came from exports from Lebedinsky GOK, i.e. $1.4 - 1.5 billion per year, which settled in the accounts of FMC Ltd. Gibraltar and FMC Trading Ltd. Liechtenstein with subsequent distribution to the beneficiaries of the parent company.

That is, the first assessment of the value of the company’s shares was carried out exclusively for the “Forced Redemption of Minority Shares” procedure based on the residual value of Lebedinsky GOK JSC and without taking into account its real profitability due to the deliberate concealment of export proceeds.

7.2. The second assessment of OJSC Lebedinsky GOK (and other assets of Metalloinvest: JSC OEMK, JSC Mikhailovsky GOK) was carried out by the authoritative Deutsche Bank AG, London Branch, upon request of Metalloinvest.

Before Deutsche Bank AG, the Client of the Forced Buyout (Metalloinvest) disclosed all financial flows received from the export of national resources, including revenue from the foreign trade division, i.e. the FMC group, owned by Mr. Skoch, Mr. Usmanov and Mr. Moshiri, on which the profit of the Metalloinvest enterprises was concentrated.

(see page 11, “Information on FMC” document “RECOMMENDED CASH OFFER by FMC ltd. for Europe Steel plc.” and Eurobond prospectus Metalloinvest Finance Ltd, Dublin appendices 2 and 5)

Sergei Yakovlevich Shuvalov, in those years Advisor to A. Usmanov and Director of Metalloinvest for corporate issues, publicly admitted: “we opened the entire cash flow to the Germans, Deutsche Bank valued LebGOK at 10 yards!”

FACT 8. The assessment of the market value of shares of Lebedinsky GOK OJSC for the purpose of forced redemption of minority shares was carried out by order of the Majority shareholder (Metalloinvest) based on incomplete data on the profitability of the Enterprise and was incorrect.

In addition, the Appraiser of Gorislavtsev and Co. Assessment" did not have economic technical, financial, or at least technical education and had a reputation among appraisers as a “stamp salesman.”

Conclusion of Queen's Council Barrister Paul O'Doherty:

Malicious failure to provide/concealment of real financial indicators of an enterprise with an understatement of the level of profitability of Lebedinsky GOK when assessing the market value of shares, for the purposes of the Forced Redemption of Minority Shares of OJSC LGOK, falls under the definition of “fraud.”

This definition of the QC Barrister is strengthened by the fact that immediately after the alienation of minority shares, the Majority Shareholder of LebGOK (Metalloinvest) ordered a second Assessment of the capitalization of the enterprise, but with full disclosure of all financial flows to the German Credit Institution Deutsche Bank AG, London branch.

The second, objective assessment of Metalloinvest enterprises showed the capitalization of Lebedinsky GOK JSC at the level of 10 billion US dollars, i.e. almost 3 times higher than the first estimate made for the forced purchase of minority shares of Lebedinsky GOK OJSC, and was confirmed by the ISSUER's Auditor (Metallotinvest) PricewaterhouseCoopers (1 Spencer Dock North Wall Quay Dublin 1) for the purpose of issuing Eurobonds Metalloinvest Finance Ltd. Dublin under the guarantees of JSC Lebedinsky GOK.

So,

These and other facts led in the summer of 2023 to the activation of A. Skoch’s lawyers in relation to Andrei Burkin, the leader of a group of disadvantaged miners from the city of Gubkin and Stary Oskol.

Every month, the head of the legal department of LGOK, Sergei Chibisov, invited the only capable member of the group, among whom there are bedridden labor invalids from LGOK, to a dialogue to negotiate the settlement of a protracted dispute about fairness in terms of determining the market price of the seized shares of LGOK under Law No. 208-FZ “On joint stock companies,” amendments to which Andrei Skoch lobbied in the State Duma of the Russian Federation in 2006.

Since the elderly miners had in their hands the original documents, which testified to the facts, after the withdrawal of the main initiator of the dialogue on justice, the former export director of Lebedinsky GOK JSC Andrei Ivanov, the focus of the attention of Andrei Skoch’s people fell on Andrei Burkin.

In April 2023, the former leader of the group of minority shareholders A. Ivanov proposed to the company and signed a compromise with Metalloinvest “On the settlement of disagreements” based on the payment of 50% of the company’s debt on trading bonuses, which they forgot to pay him during the transformation of Gazmetal into Metalloinvest. Andrei Ivanov proposed to work out this option for a compromise solution to the dispute and compensate a small group of miners for at least half of the unpaid price difference for their shares. That is, the difference between a truly independent assessment of the market value of shares ($940/share) and the $300 per share that Andrey Skoch, together with Alisher Usmanov, deposited into the notary’s account to compensate minority shareholders.

This compromise was proposed by A. Ivanov in agreement with the elderly and infirm miners due to the fact that they did not want to cause reputational damage to authoritative businessmen A. Skoch and A. Usmanov, which inevitably arises when the struggle for justice is transferred to the jurisdiction of the EU countries where the results are concentrated miners' labor in the form of material acquisitions by the beneficiaries of forced redemption.

Since January 31, 2024, Andrei Burkin, the leader of the group of labor veterans of the Lebedinsky GOK, who lost their savings in the shares of the enterprise, has been in pre-trial detention center 7, Kapotnya.

For 3.5 months, Burkin was in harsh conditions in which terrorists usually find themselves: in a cell designed for 4 people, 7 people were kept, 6 of whom were citizens of Uzbekistan and Tajikistan.

The case of Andrei Burkin, who is accused of extortion fabricated by Metalloinvest’s lawyers, was brought to the attention of the human rights association ARGA, whose President Sergei Khrabrykh exposed the gigantic scale of fraud and the dissipation of the Russian military budget by generals close to Shoigu.

The Association and the British support group (“Burkin Support Team”) is forming a parliamentary request to check the activities of Usmanov’s friend and co-owner of Metalloinvest, billionaire Farhad Moshiri, who before meeting Alisher Usmanov was an ordinary accountant. And now, with money from the export of Russian national resources, he buys and owns 94% of the Everton football club, essentially being a dummy owner of the club.

The petition posted by the British support group for Burkina describes the eerie details of the detention of the shareholder of Lebedinsky GOK JSC and his wife, who has no legal reason for the detention and the preventive measure issued by the Kuntsevsky Court of Moscow.

https://www.change.org/p/freedom-for-andrei-burkin-arrested-on-false-and-illegal-charges-by-russian-uzbek-oligarch

The entire plot of the accusation about the alleged presence of signs of Article 163 of the Criminal Code of the Russian Federation - extortion, from Metalloinvest (!), is based on an audio-linguistic examination of conversations to which Metalloinvest themselves invited Andrei Burkin through lawyers and even the general director of the company, Nazim Efendiev.

All episodes taken as the basis for the charges negotiations, have the expert’s description: “the conversation was of a business nature.” The review of the Research Institute of Expertise (No. 209.163 dated April 12, 2024) says that: the concept of “threat” (in the dialogue between Burkin and Sergei Chibisov) is defined erroneously, and the expert (from Metalloinvest) goes beyond the boundaries of his linguistic competence, discussing the long-term conflict between JSC Holding Company Metalloinvest and shareholders.

According to the famous politician, a custom-made team in the style of the 90s, with a strict procedure for detaining the Burkina family and the most severe preventive measure chosen by the court for the Burkina shareholder, was given personally by Andrei Skoch. This opinion is confirmed by facts - Farhad Moshiri lives in Monaco and works for the Everton football club. Alisher Usmanov lives in Tashkent, is involved in an extensive charity program and is trying to challenge in German courts the grounds for personal EU sanctions imposed after the outbreak of war.

If this information is confirmed, it will be interesting to know whether Andrei Skoch understands the consequences of the contract case of Burkin for Alisher Usmanov and Farhad Moshiri in the EU and Great Britain with sharply increasing reputational risks for all Metalloinvest affiliates in the light of the new round (14th package) of tightening Western sanctions.

Yuri Prokov

To be continued

Source: www.rucriminal.info

Комментариев нет:

Отправить комментарий